In this first installment, we track the dollars through the venture capital investment process.

Venture capital is money invested in startup businesses that funds activities that will lead to growth in value of the business. Let’s start at the beginning where the dollars start moving.

Certain investors choose to invest in venture capital because of the potential for very high returns. Although there is a very high risk, venture capital investments in startup companies have the potential to see 10 times more than their initial investment.

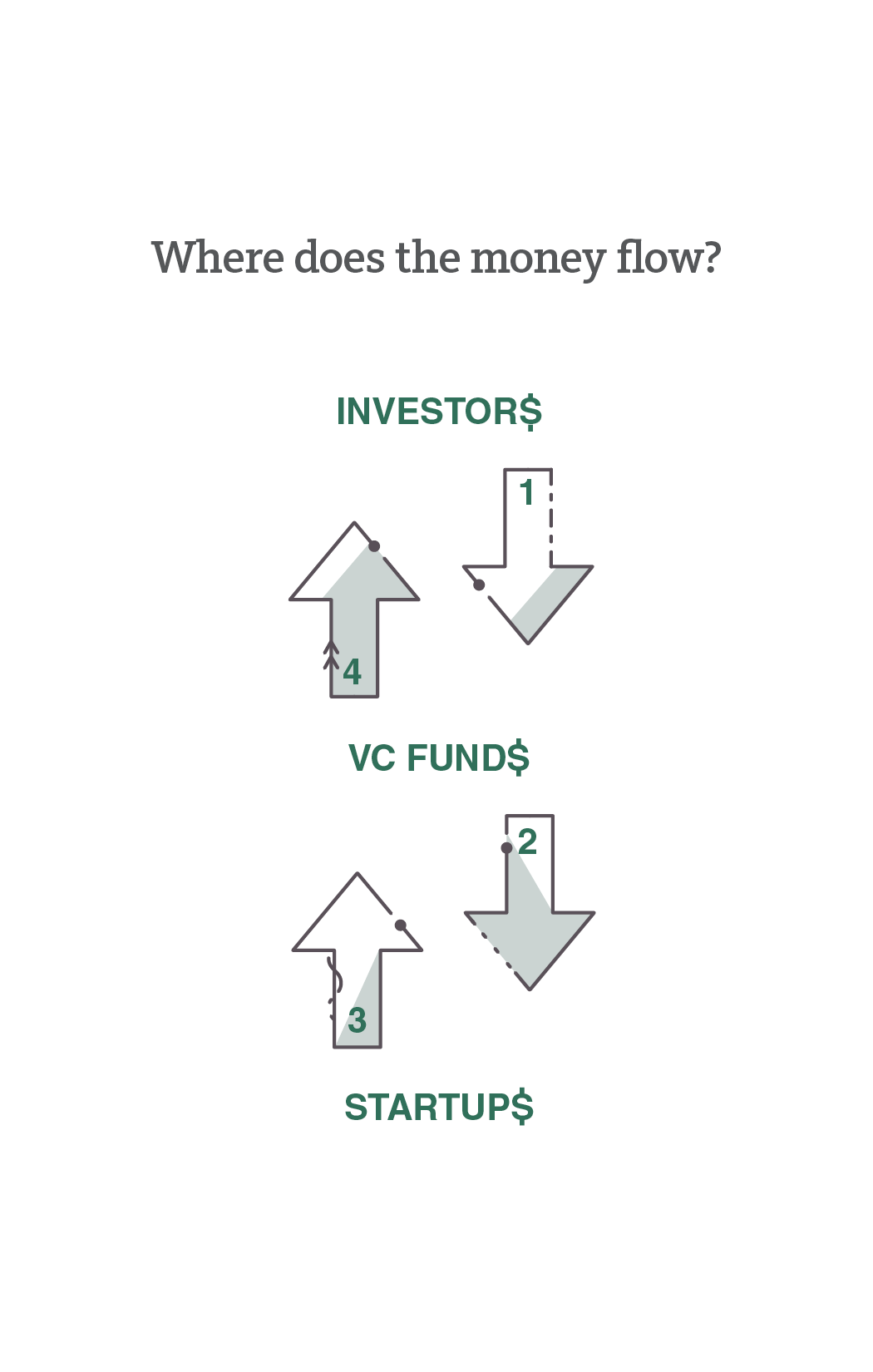

So, how do investors actually get their venture capital investment dollars into startup companies? While some investors may directly invest in startups (these are known as angels), investors often invest in venture capitals funds (VC funds) and have experienced investment managers choose and manage their investments. These managers, known as Venture Capitalists (VCs), pool investors’ money into VC funds.

When VCs decide to make an investment into a startup company, they will make a “capital call.” This means the VCs ask the VC fund investors for the money to make the investment. The VC fund then uses the money to purchase stock in the startup company.

The startup company uses the money to develop its product and increase its sales. Startup companies very rarely pay dividends to their stockholders, so at this point, the VCs and the VC fund investors must simply wait until the startup company is acquired or their stock is publicly listed and sold in an initial public offering (IPO).

When a startup company does distribute money following an acquisition or IPO, the money flows back to its stockholders, which includes the VC funds. Some VC funds may allow the VCs to recycle a portion of the money into new investments, but for the most part, the money flows back to the VC fund investors.

But, not all the money ends up with the VC fund investors. In typical VC funds, the VC fund investors pay the VCs an annual management fee, which is usually two percent of the total fund size. Furthermore, the VCs also get a share of the VC funds’ profits. As a typical example, if a VC fund generates $100 million in profits, the VCs get $20 million and the VC fund investors get $80 million.

In the next venture capital installment, we’ll look at different types of VC fund investors.

Luis Vasquez has 15 years’ experience in the startup and venture capital space. He has worked with a startup, a VC firm, a venture development organization and a venture studio/venture firm. He is now UCI Beall Applied Innovation’s Associate Director of Venture Capital Collaboration.